Real Estate Investment

Real Estate Investment

Real Estate Investment

Property Financing

Property Financing

Property Financing

IX provides a new world of straightforward, transparent, and dependable lending solutions tailored for real estate investors. Whether you're a seasoned professional or a newcomer to borrowing, IX empowers you to reach your goals with confidence.

Step into a world where one spend management platform addresses all the financial needs of real estate investors, simplifying your financial journey. Preorder your card today.

Loan Products

Loan Products

Loan Products

Designed For You

Designed For You

Designed For You

Easy Approval to

Easy Approval to

Easy Approval to

the Funded Universe

the Funded Universe

the Funded Universe

A minimum score of 620 is required, though having good credit offers additional benefits.

A minimum score of 620 is required, though having good credit offers additional benefits.

Credit

Typically 20% down for rental loans and 10% down for fix & flip loans.

Typically 20% down for rental loans and 10% down for fix & flip loans.

Property

Project info

Provide information on your project's purchase price, rehab costs, scope of work, and after repair value. You'll receive pricing within 15 minutes.

Provide information on your project's purchase price, rehab costs, scope of work, and after repair value. You'll receive pricing within 15 minutes.

Experience

No experience? no problem. We have a program to get you going. If you have experiance, meaning, you have purchased, soled or build projects within the last 36 months, rates get much better.

No experience? no problem. We have a program to get you going. If you have experiance, meaning, you have purchased, soled or build projects within the last 36 months, rates get much better.

Credit

A minimum score of 620 is required, though having good credit offers additional benefits.

Property

Typically 20% down for rental loans and 10% down for fix & flip loans.

Experience

No experience? no problem. We have a program to get you going. If you have experiance, meaning, you have purchased, soled or build projects within the last 36 months, rates get much better.

Project info

Provide information on your project's purchase price, rehab costs, scope of work, and after repair value. You'll receive pricing within 15 minutes.

Fix and flip

Bridge

New Construction

DSCR

Portfolio

Fix and flip

Bridge

New Construction

DSCR

Portfolio

Fix & Flip

Bridge

New construction

DSCR

Rental portfolio

Fix and flip

Bridge

New Construction

DSCR

Portfolio

Fix & Flip

Bridge

New construction

DSCR

Rental portfolio

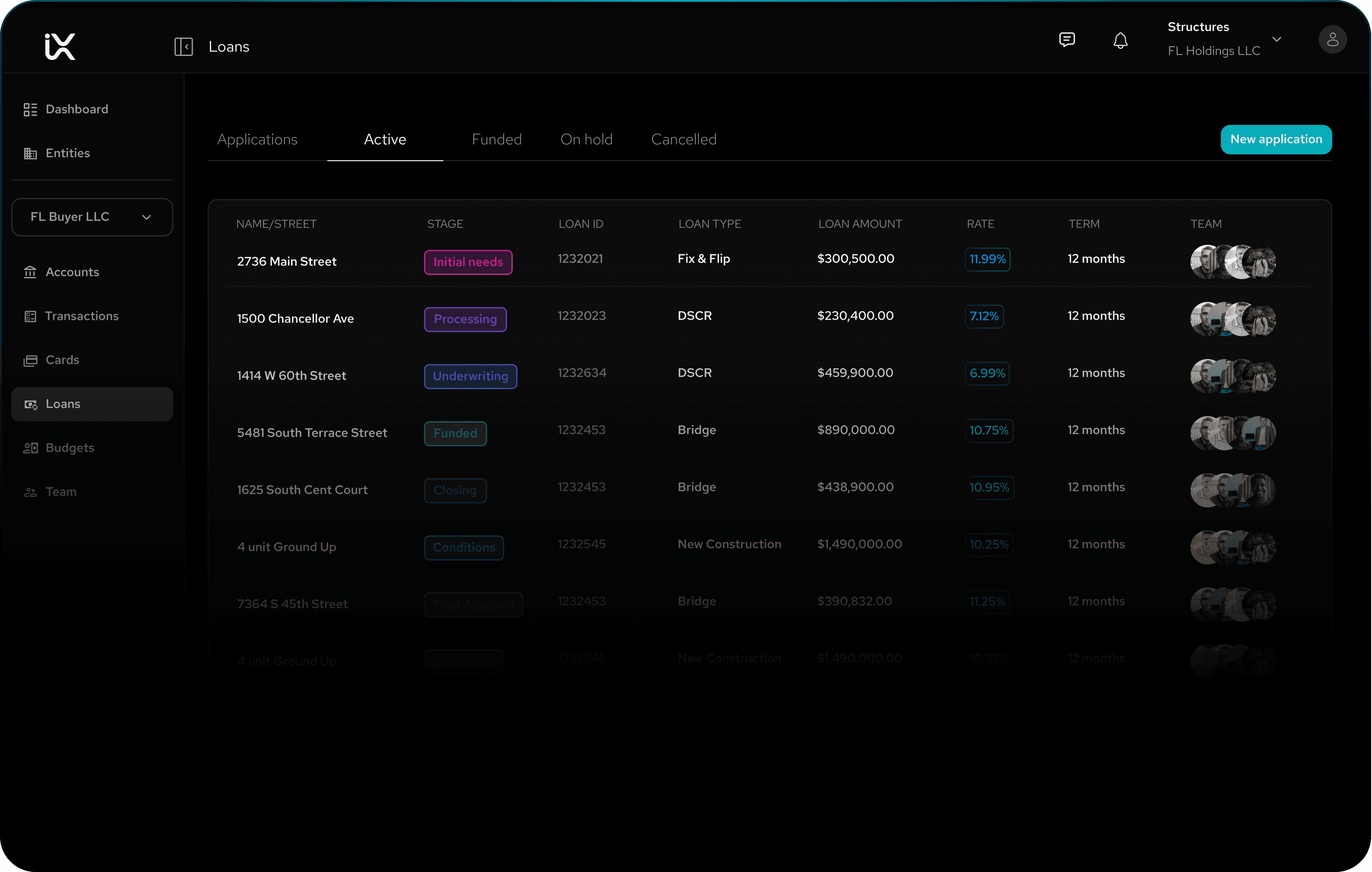

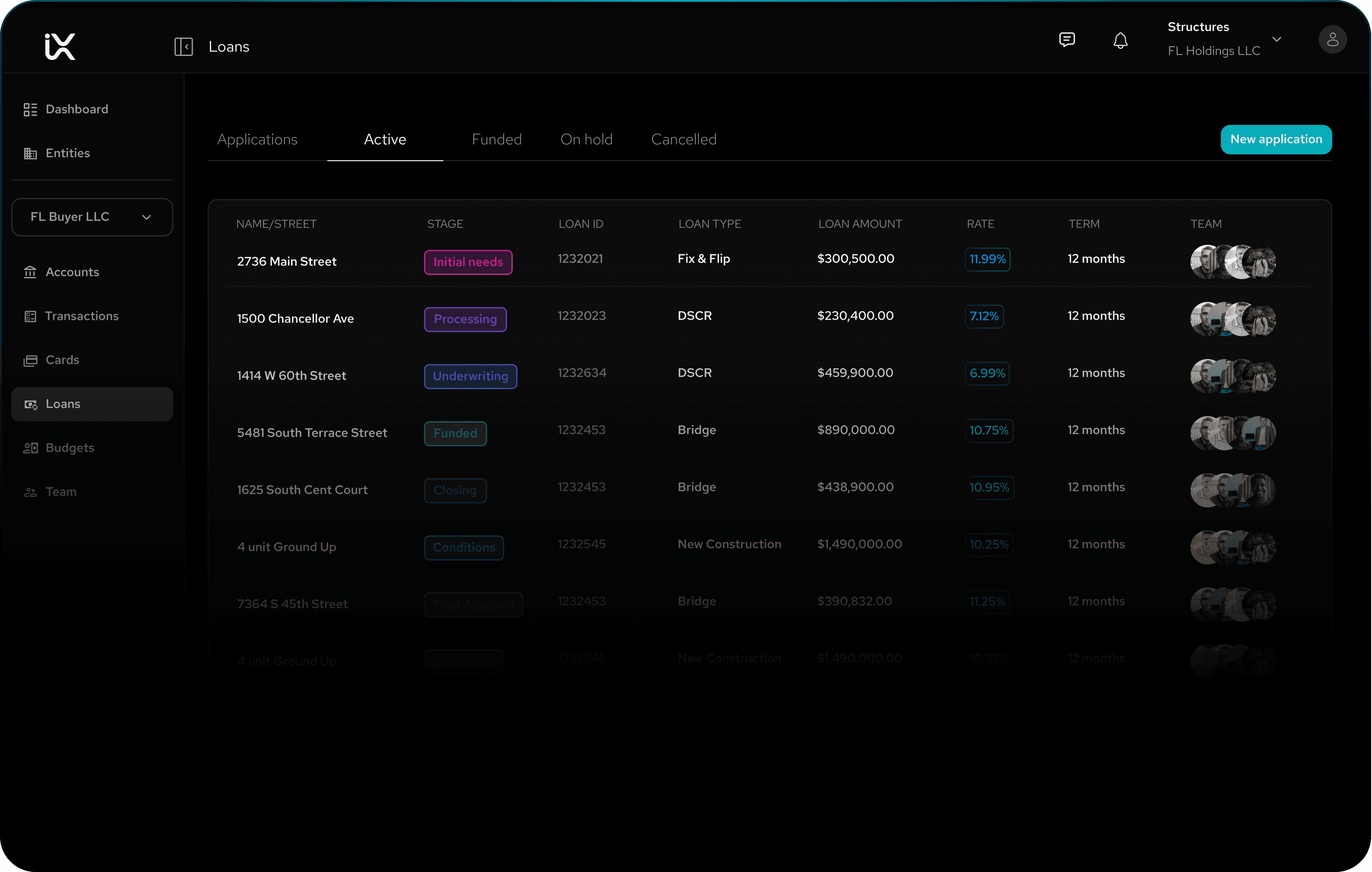

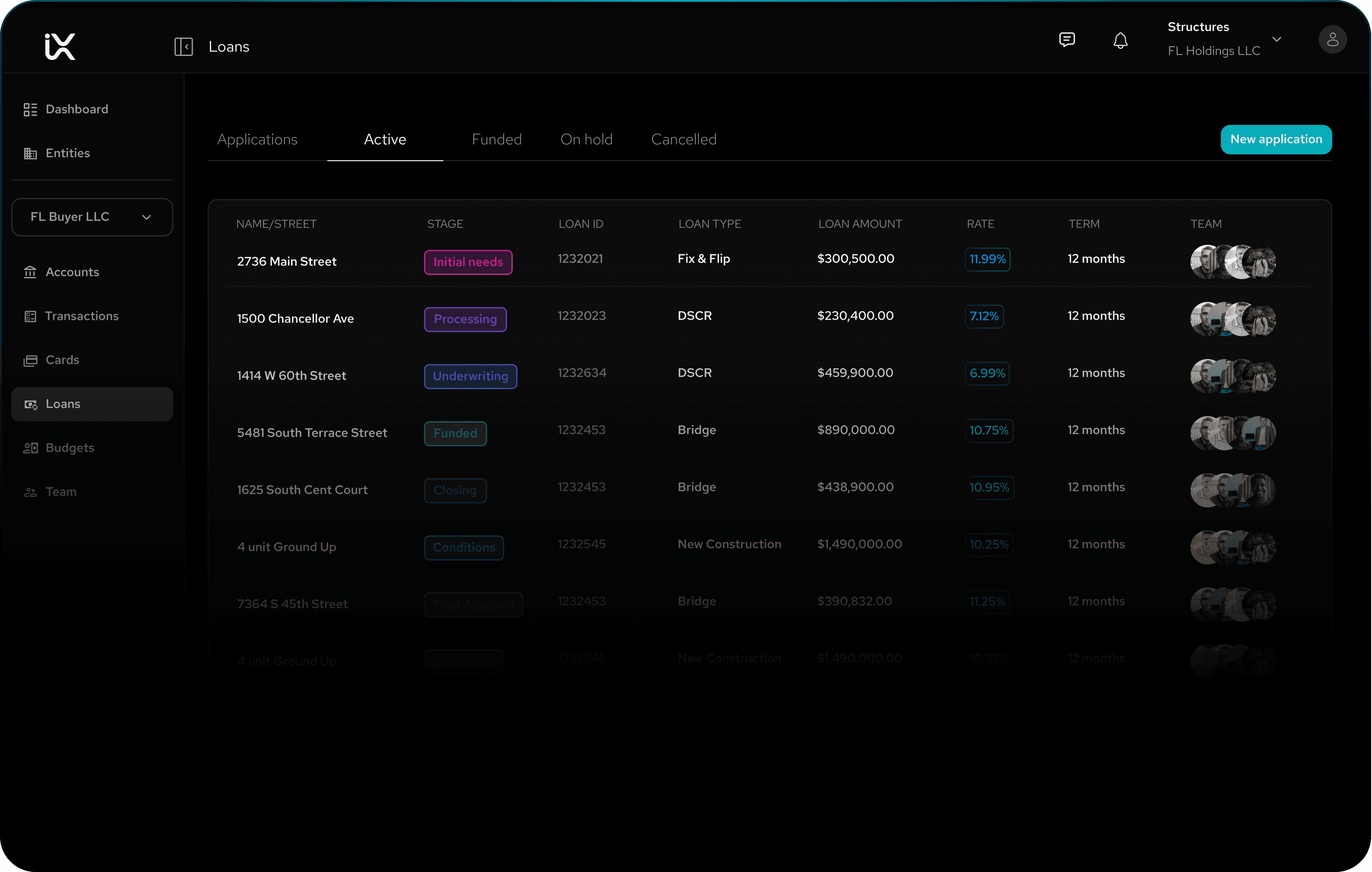

The Ultimate

The Ultimate

Financing Experience

Financing Experience

Secure funding for purchases or refinances with our streamlined platform. Get clear guidance, dedicated support, and easy document submission – all for a smooth liftoff.

Secure funding for purchases or refinances with our streamlined platform. Get clear guidance, dedicated support, and easy document submission – all for a smooth liftoff.

The Ultimate

Financing Experience

Step into a world where one spend management platform addresses all the financial needs of real estate investors, simplifying your financial journey. Preorder your card today.

Easy Application

Easy Application

Easy Application

Submit your loan application in less than 1 minute

Submit your loan application in less than 1 minute

Submit your loan application in less than 1 minute

Submit your loan application in less than 1 minute

Instant Terms

Instant Terms

Instant Terms

Get your loan terms instantly after submitting your application

Get your loan terms instantly after submitting your application

Get your loan terms instantly after submitting your application

Get your loan terms instantly after submitting your application

Clear Guidance

Clear Guidance

Clear Guidance

Upload documents easily with our clear checklist, get help fast, and track your loan in real-time

Upload documents easily with our clear checklist, get help fast, and track your loan in real-time

Upload documents easily with our clear checklist, get help fast, and track your loan in real-time

Upload documents easily with our clear checklist, get help fast, and track your loan in real-time

Direct Message

Direct Message

Direct Message

Communicate with the IX team and get answers to your questions instantly

Communicate with the IX team and get answers to your questions instantly

Communicate with the IX team and get answers to your questions instantly

Communicate with the IX team and get answers to your questions instantly

Scale with IX

Scale with IX

Scale with IX

IX simplifies access to capital, fueling your portfolio's exponential growth with an unmatched experience.

IX simplifies access to capital, fueling your portfolio's exponential growth with an unmatched experience.

IX simplifies access to capital, fueling your portfolio's exponential growth with an unmatched experience.

IX simplifies access to capital, fueling your portfolio's exponential growth with an unmatched experience.

Why

Why

IX

IX

Experience the speed of seamless applications, instant access to terms, and effortless loan lifecycle management with our platform.

Experience the speed of seamless applications, instant access to terms, and effortless loan lifecycle management with our platform.

Fast and Efficient Funding

Apply in minutes, get instant terms. Decide with confidence.

Intuitive Borrower Portal

Our portal guides you through the entire process from application to funding. You're in control every step.

Transparent and Guaranteed.

IX offers transparent pricing from the start, so you know exactly what to expect at closing.

We Let Our

Clients Speak For Us

Curious about how savvy investors like these are teaming up with us to finance their projects? Join the ranks and uncover the secrets to successful partnership

“It was the most efficient process.”

I submitted the application in less than a minute and received terms within 15! The process of uploading documents was straightforward, and I could easily track my progress. Everything was simple, and we closed quickly with an excellent rate.

Adam

Florida real estate investor

“IX closed my loan in less than 5 days!”

I had a tight deadline to close on a property. My previous lender changed the rate multiple times, but IX stepped in just in time. With them, I got a lower rate, used my existing appraisal, and closed the deal in just 4 days.

Jason

California real estate investor

“I always get what they promise!“

I used to work with Kiavi, but they consistently provided lower property valuations. Switching to IX has been a game-changer. Their rapid appraisal process allows me to track status in real-time, and valuations consistently meet expectations.

Jossue

Florida real estate investor

We Let Our

Clients Speak For Us

Curious about how savvy investors like these are teaming up with us to finance their projects? Join the ranks and uncover the secrets to successful partnership

“It was the most efficient process.”

I submitted the application in less than a minute and received terms within 15! The process of uploading documents was straightforward, and I could easily track my progress. Everything was simple, and we closed quickly with an excellent rate.

Adam

Florida real estate investor

“IX closed my loan in less than 5 days!”

I had a tight deadline to close on a property. My previous lender changed the rate multiple times, but IX stepped in just in time. With them, I got a lower rate, used my existing appraisal, and closed the deal in just 4 days.

Jason

California real estate investor

“I always get what they promise!“

I used to work with Kiavi, but they consistently provided lower property valuations. Switching to IX has been a game-changer. Their rapid appraisal process allows me to track status in real-time, and valuations consistently meet expectations.

Jossue

Florida real estate investor

Why

IX

Step into a world where one spend management platform addresses all the financial needs of real estate investors, simplifying your financial journey. Preorder your card today.

Fast and Efficient Funding

Apply in minutes, get instant terms. Decide with confidence.

Intuitive Borrower Portal

Our portal guides you through the entire process from application to funding. You're in control every step.

Transparent and Guaranteed.

IX offers transparent pricing from the start, so you know exactly what to expect at closing.

We Let Our

Clients Speak For Us

Curious about how savvy investors like these are teaming up with us to finance their projects? Join the ranks and uncover the secrets to successful partnership

“It was the most efficient process.”

I submitted the application in less than a minute and received terms within 15! The process of uploading documents was straightforward, and I could easily track my progress. Everything was simple, and we closed quickly with an excellent rate.

Adam

Florida real estate investor

“IX closed my loan in less than 5 days!”

I had a tight deadline to close on a property. My previous lender changed the rate multiple times, but IX stepped in just in time. With them, I got a lower rate, used my existing appraisal, and closed the deal in just 4 days.

Jason

California real estate investor

“I always get what they promise!“

I used to work with Kiavi, but they consistently provided lower property valuations. Switching to IX has been a game-changer. Their rapid appraisal process allows me to track status in real-time, and valuations consistently meet expectations.

Jossue

Florida real estate investor

Speak with an

Speak with an

Account Executive

Account Executive

Ready to conquer the world of real estate? Get your questions answered by one of our Account Executives. We're here to help you build your empire.

Ready to conquer the world of real estate? Get your questions answered by one of our Account Executives. We're here to help you build your empire.

Get the

Get the

Answers

Answers

01

What types of loans do you offer?

02

What is the primary focus of your lending services?

03

How can I apply for a loan with your private money lending firm?

04

What is a Fix and Flip loan?

05

What are the eligibility criteria for a Fix and Flip loan?

View more

01

What types of loans do you offer?

02

What is the primary focus of your lending services?

03

How can I apply for a loan with your private money lending firm?

04

What is a Fix and Flip loan?

05

What are the eligibility criteria for a Fix and Flip loan?

View more

Speak with an

Account Executive

Ready to conquer the world of real estate? Get your questions answered by one of our Account Executives. We're here to help you build your empire.

Get the

Answers

01

What types of loans do you offer?

02

What is the primary focus of your lending services?

03

How can I apply for a loan with your private money lending firm?

04

What is a Fix and Flip loan?

05

What are the eligibility criteria for a Fix and Flip loan?

View more

Speak with an

Account Executive

Ready to conquer the world of real estate? Get your questions answered by one of our Account Executives. We're here to help you build your empire.

Get the

Answers

01

What types of loans do you offer?

02

What is the primary focus of your lending services?

03

How can I apply for a loan with your private money lending firm?

04

What is a Fix and Flip loan?

View more

Revolutionizing the Investor Experience

600 California Street 11th Floor

San Francisco, CA 94108

(833) 446-2001

hello@ix.finance

© 2023 IX Finance, LLC. All Rights Reserved.

This is not a commitment to lend. All offers of credit are subject to approval. Restrictions may apply. IX Finance, LLC reserves the right to amend rates and guidelines. NMLS ID 2386867. Loans made or arranged pursuant to a California Finance Lenders Law License 60DBO-173082

© 2023 IX Technology Corp. "IX" and the IX logo are registered trademarks of the company. The IX Visa Corporate Card and Banking services provided by Evolve Bank & Trust® ,Members FDIC respectively.

We calculate average savings as a percentage of an illustrative customer's total card spending when using IX Technology features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. IX Technology delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary. Please visit our Terms of Service for more details. Read our Editorial Guidelines and Privacy Policy.

Revolutionizing the Investor Experience

600 California Street 11th Floor

San Francisco, CA 94108

(833) 446-2001

hello@ix.finance

© 2023 IX Finance, LLC. All Rights Reserved.

This is not a commitment to lend. All offers of credit are subject to approval. Restrictions may apply. IX Finance, LLC reserves the right to amend rates and guidelines. NMLS ID 2386867. Loans made or arranged pursuant to a California Finance Lenders Law License 60DBO-173082

© 2023 IX Technology Corp. "IX" and the IX logo are registered trademarks of the company. The IX Visa Corporate Card and Banking services provided by Evolve Bank & Trust® ,Members FDIC respectively.

We calculate average savings as a percentage of an illustrative customer's total card spending when using IX Technology features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. IX Technology delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary. Please visit our Terms of Service for more details. Read our Editorial Guidelines and Privacy Policy.

Revolutionizing the Investor Experience

600 California Street 11th Floor

San Francisco, CA 94108

(833) 446-2001

hello@ix.finance

© 2023 IX Finance, LLC. All Rights Reserved.

This is not a commitment to lend. All offers of credit are subject to approval. Restrictions may apply. IX Finance, LLC reserves the right to amend rates and guidelines. NMLS ID 2386867. Loans made or arranged pursuant to a California Finance Lenders Law License 60DBO-173082

© 2023 IX Technology Corp. "IX" and the IX logo are registered trademarks of the company. The IX Visa Corporate Card and Banking services provided by Evolve Bank & Trust® ,Members FDIC respectively.

We calculate average savings as a percentage of an illustrative customer's total card spending when using IX Technology features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. IX Technology delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary. Please visit our Terms of Service for more details. Read our Editorial Guidelines and Privacy Policy.